Summit Real Estate Group has engaged a leading commercial real estate visual media company to create and produce content that enhances the marketing efforts of Summit’s ground-up industrial development projects. Oval Room Group will produce media packages to include videography, animated aerial renderings, and interactive aerial visuals (360° HotSpot Mapping) that, in conjunction with the efforts of our leasing and investment sale partners, will best position each project in its respective market.

Importantly, as part of this initiative, Summit has launched a dedicated project marketing website that serves as a single destination for information and resources on our industrial development projects.

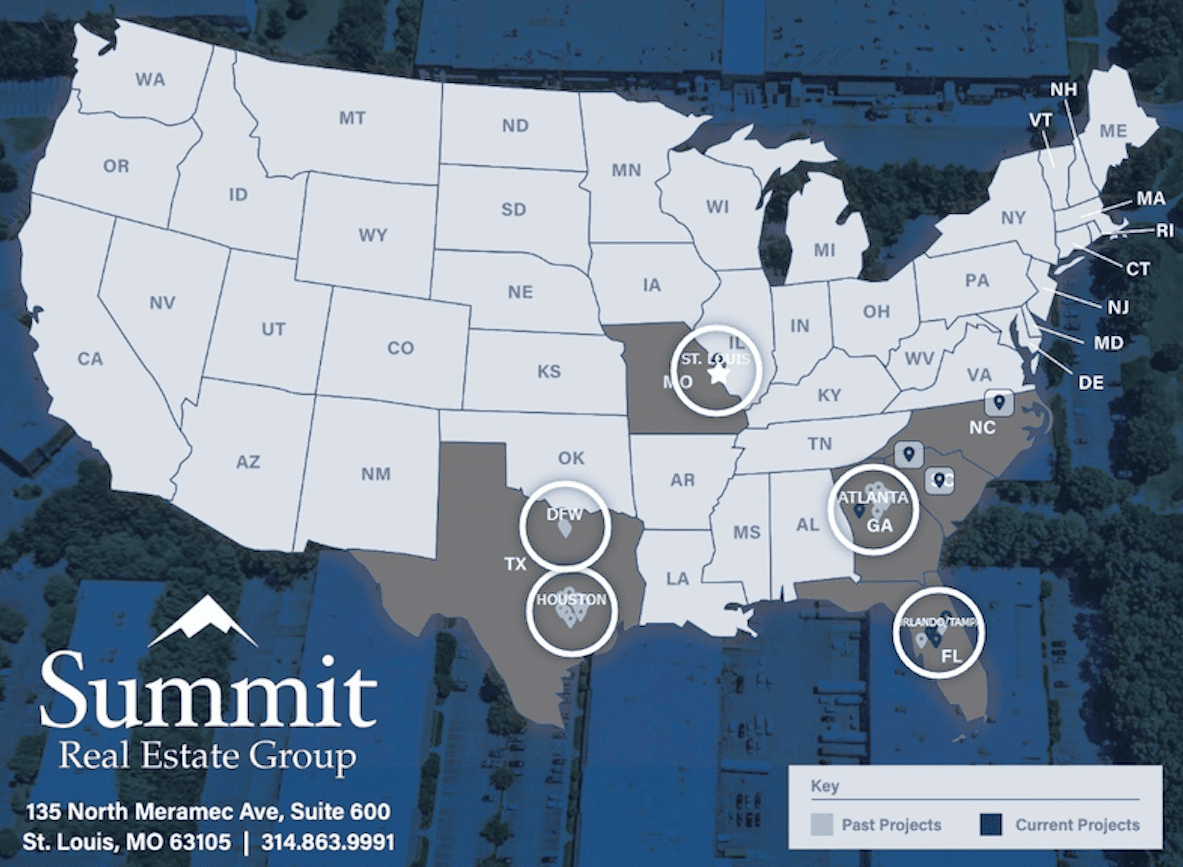

The decision to work with Oval Room Group and launch a dedicated website was driven in part by Summit’s latest private equity real estate fund – Arrowrock US Industrial Fund IV, LP. Marketing our projects to prospective tenants and users is an important component of our Fund IV strategy. Announced Summer 2022, Fund IV will develop speculative, multi-tenant industrial assets in high-growth markets across the U.S. Southeast and Texas with an opportunity to generate superior risk-adjusted returns. The strategy is guided by Summit’s belief that supply and demand in the industrial asset category are unbalanced due, in part, to a resurgence in US manufacturing, supply chain safety stock needs, and increased e-commerce adoption. The focus of Fund IV will be the development of buildings typically ranging in size from 200,000 to 400,000 square feet that incorporate features required by todays tenants including high dock count, trailer and outdoor storage, and enhanced electric service. Summit’s projects will range from $20 million to $100 million in total capitalization with those projects at the higher end of this range likely representing multi-building, multi-phase “industrial parks”.

An active industrial developer in the U.S. Southeast for years, Summit has assembled a significant portfolio and pipeline for Fund IV that includes projects in seven markets and represents 3 million square feet. The portfolio currently includes Gateway 29 in Greenville-Spartanburg, SC, Troup Logistics Center in LaGrange, GA, and 451 Commerce Park in Orlando, FL The pipeline portfolio (under contract and LOI) currently features projects in Raleigh (NC), Tampa (FL), Plant City (FL), and Columbia (SC).

For more information about Arrowrock US Industrial Fund IV, LP please contact Matt Lederman.